- (814) 226 - 6580

- cia@carrierins.com

- 21823 Route 68 Suite 3 Clarion, PA 16214

Hours

| Monday | 9 AM - 5 PM |

| Tuesday | 9 AM - 5 PM |

| Wednesday | 9 AM - 5 PM |

| Thursday | 9 AM - 5 PM |

| Friday | 9 AM - 5 PM |

| Saturday | CLOSED |

| Sunday | CLOSED |

Contact Us

Local: (814) 226-6580

Toll Free: (800) 822-9486

Fax: (814) 226-8514

Home & Property Insurance

Home Insurance

Homeowner insurance is crucial because it protects your biggest investment, your home, from unforeseen damages and losses. It provides financial security, ensuring that you can rebuild or repair your property and replace belongings in case of incidents like fires, thefts, or natural disasters. We can help you find the right coverage by leveraging our expertise and access to multiple insurance providers.

Our goal is to assist you in finding the optimal home insurance coverage that suits your needs, providing you with peace of mind and protecting your most valuable asset.

Our goal is to assist you in finding the optimal home insurance coverage that suits your needs, providing you with peace of mind and protecting your most valuable asset.

Discover Your Risks

Click on the interactive slider below to discover risks that homeowner's insurance can cover.

Are Your Home Insurance Needs Met?

We simplify the process of finding the right insurance coverage for your home, ensuring it is adequately protected. Every home is unique, and our policies are designed to cater to the individual requirements of your home and lifestyle. We work closely with you as your insurance advisor, assessing the risks your home faces and tailoring the coverage accordingly, because your home deserves comprehensive insurance that goes above and beyond.

When it comes to home insurance, there are various options available to suit your home and lifestyle. As you assess your home insurance choices, it's important to take into account the following coverage options →

When it comes to home insurance, there are various options available to suit your home and lifestyle. As you assess your home insurance choices, it's important to take into account the following coverage options →

Liabilities

- Fire

- Water/Sewage Backup

- Theft

- Property Damage

- Personal Liability

- Personal Injury

- Medical Expenses

- Flood Coverage

- Loss of Use

- Excess Liability

Protections

- Personal Property

- Tools

- Jewelry, Fine Art

- Electronics

- Classic Cars

- Wine Collections

- Fine China

- Furniture

- Hunting Camps

- Second Homes

Upgrade your Financial Security with Homeowner's Insurance

Carrier Insurance Agency has extensive experience and expertise in the insurance industry, allowing us to provide personalized advice and tailor coverage options specifically to your needs. Our agency works with multiple insurance carriers, giving you access to a wide range of options and ensuring that you can find the best coverage at competitive rates.

Other Ways To Protect Your Home

Home & Auto Bundles

Bundling homeowner's and auto insurance can save you money and simplify your insurance management.

Renter's & Auto Bundles

Bundling renters and auto insurance can offer cost savings and convenience for renters looking for coverage.

Flood Insurance

Flood insurance shields assets, offering crucial financial security during water-related emergencies.

Renters Insurance

Renters insurance offers essential protection, covering belongings and liability, ensuring peace of mind for tenants.

Secondary Home Insurance

Insuring secondary homes ensures financial protection for camps and vacation properties, guarding against damage and loss.

Condo Insurance

Condo insurance secures your unit and belongings, offering coverage against damage, theft, and liability within shared spaces.

Rental Property Insurance

Rental property insurance safeguards your investment, providing coverage for damages and liability.

Mobile Home Insurance

Mobile home insurance protects mobile homes and belongings, accounting for unique risks and tailored coverage.

Vacant Home Insurance

Vacant home insurance prevents financial risks, covering damages and liabilities when your property is unoccupied.

Flood Insurance

Flood insurance is essential for everyone, regardless of whether they live in a designated floodplain or not. Floods can occur in any location due to various factors such as heavy rainfall, storms, or infrastructure failures. Without flood insurance, individuals and businesses face significant financial risks, as standard homeowners' insurance policies typically do not cover flood damage. Having flood insurance provides a proactive approach to managing potential risks associated with flooding.

Having flood insurance is crucial because it provides financial protection and peace of mind in the face of a flood. If you do not have flood insurance when a flood hits, you may be left with the cost of repairing or rebuilding your property. Flood insurance offers peace of mind, regardless of your location.

Nebraska Bridge, Tionesta, PA

Image by PennDOT

The Facts About Flood Insurance

- Homeowner's Policies do not typically cover damage from floods

- Only a small percentage of homes are covered by National Flood Insurance Program (NFIP)

- Private Flood Insurance goes above and beyond NFIP requirements

- Floods are a risk everywhere, not just flood planes

- Melting snow is enough to cause a basement flood

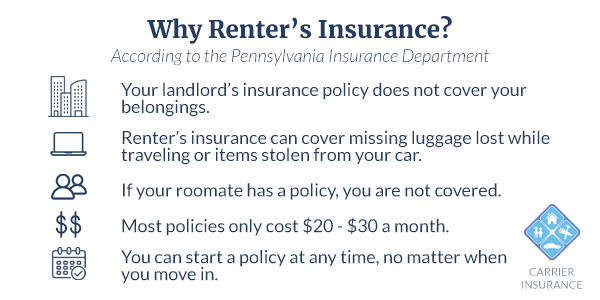

Renter's Insurance

A landlord's insurance policy typically focuses on protecting the property itself, the building's structure, and the landlord's interests. This coverage may include damage to the building caused by natural disasters, fire, or other covered events. However, it's crucial for renters to understand that a landlord's insurance policy usually does not extend to cover their personal belongings or liability.

As a tenant, it is essential to have your own rental insurance, often referred to as renter's insurance, to safeguard your possessions and provide liability protection. Renter's insurance ensures that your belongings are covered in case of theft, damage, or loss due to covered incidents, such as fire or water damage. Additionally, it offers liability coverage in case someone is injured in your rental unit and decides to pursue legal action.

As a tenant, it is essential to have your own rental insurance, often referred to as renter's insurance, to safeguard your possessions and provide liability protection. Renter's insurance ensures that your belongings are covered in case of theft, damage, or loss due to covered incidents, such as fire or water damage. Additionally, it offers liability coverage in case someone is injured in your rental unit and decides to pursue legal action.

Renter's Insurance Coverage

- Personal Posessions

- Fire

- Theft

- Flood Coverage

- Water/Sewage Backup

- Personal Liability

- Loss of Use

Secondary home Insurance

Secondary home insurance, also known as vacation home insurance or seasonal home insurance, is a specialized type of insurance coverage designed for properties that are not the primary residence of the policyholder. This insurance provides protection for cabins, hunting camps, cottages, vacation homes, second homes, and more.

Secondary home insurance typically offers similar coverage to that of a standard homeowners insurance policy, including property damage caused by perils such as fire, theft, vandalism, and certain natural disasters. Since secondary homes are often left unoccupied for extended periods, this type of insurance may also offer specific provisions to account for potential risks associated with vacancy, such as coverage for water damage or loss of personal belongings.

It's essential for owners of secondary homes to obtain this specialized insurance to ensure their property is adequately protected, as a regular homeowners insurance policy on their primary residence may not fully cover the unique risks associated with secondary properties. Policies and coverage options can vary, so call us today to discuss your personal needs.

Secondary home insurance typically offers similar coverage to that of a standard homeowners insurance policy, including property damage caused by perils such as fire, theft, vandalism, and certain natural disasters. Since secondary homes are often left unoccupied for extended periods, this type of insurance may also offer specific provisions to account for potential risks associated with vacancy, such as coverage for water damage or loss of personal belongings.

It's essential for owners of secondary homes to obtain this specialized insurance to ensure their property is adequately protected, as a regular homeowners insurance policy on their primary residence may not fully cover the unique risks associated with secondary properties. Policies and coverage options can vary, so call us today to discuss your personal needs.

Lower Costs

Secondary home insurance often costs less than primary home insurance because secondary homes are typically occupied for a shorter duration and contain less valuable possessions.

Condo Insurance

Condominium insurance is essential because it protects your investment, personal belongings, and finances, while also offering liability coverage and providing peace of mind. Without condo insurance, you could face significant financial losses and potential legal challenges in case of unfortunate events.

Why You Need Condo Insurance

- Protect Your Investment

- Personal Posessions Protection

- Personal Liability

- Loss Assessment Coverage

- Loss of Use Coverage

- Natural Disaster Protection

- Peace of Mind, Even Hundreds of Miles Away

What is Loss Assessment Coverage?

In a condominium, common areas are shared by all unit owners. If there's damage to these communal areas or if the condo association faces a liability claim, you could be required to contribute to the expenses. Condo insurance can cover your share of such loss assessments.

Rental Property Insurance

Rental property insurance, also known as landlord insurance, is essential for protecting property owners who lease out their residential or commercial properties. This type of insurance provides coverage for various risks specific to rental properties, such as property damage caused by tenants, natural disasters, or accidents. It also includes liability coverage in case a tenant or visitor gets injured on the property, protecting the landlord from potential lawsuits and financial liabilities. Rental property insurance offers peace of mind to landlords, ensuring that their investment is protected and potential financial losses are minimized in case of unforeseen events.

Rental property insurance and home insurance differ in their coverage focus and target audiences. Home insurance is designed for homeowners and provides coverage for the physical structure of the home, personal belongings, liability, and additional living expenses in case of temporary displacement due to covered perils. On the other hand, rental property insurance, also known as landlord insurance, is tailored for property owners who rent out their properties.

Rental property insurance typically includes coverage for the physical structure of the rental property, liability protection, and loss of rental income, but it does not cover the personal belongings of the tenants since tenants should obtain their renters' insurance for that purpose. Rental property insurance is essential for landlords to protect their investment and income stream, while home insurance is crucial for homeowners to safeguard their property and personal belongings. Contact us today to assess all the options for Rental Property Insurance.

Mobile home Insurance

Mobile or Manufactured?

Mobile homes and manufactured homes are both types of factory-built residences, but there are some key differences between them. Mobile homes are generally older models, built before 1976, and were constructed to lower standards. In contrast, manufactured homes are built after 1976 and adhere to stricter construction regulations set by the U.S. Department of Housing and Urban Development (HUD).

Mobile home insurance is specifically designed to protect mobile or manufactured homes, which often have different construction materials and requirements than traditional houses.

Mobile home insurance is tailored to address the unique characteristics and risks associated with mobile homes, which differ significantly from traditional homes. Mobile home insurance often includes coverage for transportability and anchoring systems, as well as coverage for damage caused during transportation. Given their lighter weight and susceptibility to high winds, policies may also include provisions for windstorm protection. Additionally, mobile homes might be at higher risk for certain perils, like damage from hail or snow buildup on their roofs, which traditional homes may not face as frequently.

Overall, mobile home insurance is designed to address the specific needs and risks of these dwellings, ensuring that homeowners have the appropriate coverage for their unique type of residence.

Mobile home insurance is tailored to address the unique characteristics and risks associated with mobile homes, which differ significantly from traditional homes. Mobile home insurance often includes coverage for transportability and anchoring systems, as well as coverage for damage caused during transportation. Given their lighter weight and susceptibility to high winds, policies may also include provisions for windstorm protection. Additionally, mobile homes might be at higher risk for certain perils, like damage from hail or snow buildup on their roofs, which traditional homes may not face as frequently.

Overall, mobile home insurance is designed to address the specific needs and risks of these dwellings, ensuring that homeowners have the appropriate coverage for their unique type of residence.

Vacant Home Insurance

Vacant home insurance is a specialized type of insurance designed to provide coverage for properties that are unoccupied for an extended period. Vacant homes face unique risks, such as vandalism, theft, and property damage, as they lack the presence of occupants to deter potential hazards. Traditional home insurance policies typically exclude coverage for homes left vacant for more than 30 to 60 days.

Vacant home insurance, however, offers protection for the structure and may include additional provisions for liability coverage and vandalism protection. It provides homeowners with peace of mind, knowing that their vacant property is safeguarded against unforeseen events while they are away or awaiting sale. Whether the vacancy is due to a renovation, seasonal absence, or pending sale, vacant home insurance serves as a crucial safeguard for property owners during periods of prolonged vacancy.

Personalized Solutions

Our experienced agents take the time to understand your specific requirements, preferences, and budgetary considerations. Whether it's home, auto, life, or any other type of insurance, we customize the policy by considering factors such as your assets, lifestyle, and future goals. With our personalized approach, you can have confidence that you are receiving a tailored insurance solution that offers the protection you need and the peace of mind you deserve.